Whitney Tilson’s email to investors discussing his analyst’s bull case for Tesla Inc (NASDAQ:TSLA).

One of my analysts, Kevin DeCamp, has owned both a Tesla car and the stock for years and remains bullish on it.

Despite my contrary views, I’ve always welcomed his viewpoint and encouraged him to write this article outlining his thesis.

Q2 hedge fund letters, conference, scoops etc

He’s likely going to publish it somewhere, but before doing so I wanted to send it first to my Tesla email list to get feedback.

Thanks!

On the flight to my first Tesla shareholder meeting last month, I was reminded of the mock funeral that a group of GM EV1 owners held when the company took back their leased cars and crushed them against their will in 2003. Clearly, Tesla’s success has gone way beyond the EV1, but the total global fleet of 1.2 billion vehicles makes Tesla’s sales to date of ~600,000 cars seem like a drop in the bucket (0.05% of total global vehicles). With EV (electric vehicle) competition finally arriving from well-funded giants and numerous red flags surfacing, is this the end of the road for Tesla (TSLA)?

As a long-time Tesla shareholder and car owner, I am accustomed to the negativity surrounding the company – yet this year seems particularly concerning. Executive departures, price cuts, layoffs, autopilot crashes, SEC battles, countless lawsuits, quality issues, and a costly capital raise have all taken a toll.

As the meeting began, I couldn’t help but think that the shareholders were like a family at a hospital insisting that their loved one was only having a minor setback when in reality they were in critical condition in ICU. Never underestimate the power of denial.

Tesla bulls can brush these off as growing pains, but the CDS spike, bond rout, and the stock price breaking through long-term support could be warning signs that the company is on the road to needing life support.

Unlike most Tesla bulls, I’ve carefully considered the bear case over the years. More recently, I doubt there are any bulls more familiar with it as I’m an analyst for Whitney Tilson of Empire Financial Research, who made a big call in March that the stock would hit $100 by the end of the year.

I’ve forced myself over the last few months to analyze every possible facet of the bear thesis deeper than I ever had and question every one of my assumptions.

I wanted to make sure that I hadn’t fallen into the trap Charlie Munger warns about. He has said that the human mind is like the human egg – it has a shut-off device such that once an idea gets inside, it doesn’t allow a new one to enter. Could I be experiencing this in real time?

Ultimately, I concluded that I wasn’t. In fact, I’m now more confident than ever that Tesla will make it through this transition period and continue to dominate and lead the EV market.

While there are many elements to the bear thesis, the crux of it is that demand for Tesla’s cars is hitting a wall and thus we’re in the early stages of this becoming a broken growth stock. I believe that this is completely wrong for a number of reasons.

The legacy automakers are far from all in

For years I’ve been hearing about the incoming tidal wave of competition that will inevitably crush Tesla’s growth and margins. This is a compelling argument, but it is unlikely to happen due to a variation of the innovator’s dilemma, Tesla’s first mover advantage, continued lead, and the new market demand it’s creating.

Another valuable lesson from Charlie Munger is that incentives drive everything. Setting aside the inferior 204-mile range of the Audi e-tron, this vehicle is the most impressive of the competitors to challenge Tesla to date. Yet, what is the incentive for Audi to sell money-losing e-trons as opposed to their other, profitable models? On the contrary, Tesla’s entire existence depends on selling as many electric cars as possible.

This is likely the reason the legacy automakers have put more effort into headlines describing their future EV plans than securing battery supplies – a major mistake since a massive amount of battery supply is necessary for any serious EV program. In addition, the battery pack is an integral and crucial part of the EV powertrain – you would think that any serious EV manufacturer would play an integral part in its design and manufacture.

However, the Chevy Bolt – the original “Tesla Killer” – is a great example of the industry’s approach. 70% of the Bolt’s components are made by LG Chem versus 90% of the Model 3’s being made in house by Tesla.

It’s not surprising, therefore, that the Bolt has had no success in Norway, where more than half of all car sales are EVs thanks to big government incentives. GM has sold a total of 223 Bolts since introducing it years ago – a number that the Tesla Model 3 has easily beaten many days this year.

Battery supply is a major issue as Audi has been forced to slow production of its e-tron and delay the launch of its next model due to battery shortages from LG Chem. LG Chem is also a major battery supplier to other OEMs, so not surprisingly it’s taken advantage of this dynamic and raised prices.

If I were an investor in Volkswagen, Audi’s parent company, I would have mixed feelings about this dynamic. Since Audi appears to take a large loss on every e-tron sold, then I should be happy that the battery shortage is dampening the sales of money-losing EVs. But does failure in this important emerging market hurt the company in the long run? It’s a classic innovator’s dilemma. No wonder GM destroyed those EV1s...

VW has estimated that the industry will need the equivalent of 40 Tesla gigafactories by 2025 in order to meet battery demand, assuming that 25% of sales volumes are hybrid or fully electric vehicles. Where are all the plans for these factories? Not to worry, VW has taken a page out of Elon Musk’s playbook and recently announced that its battery supply is “secured.”

Also, VW is just waking up to the fact that the Tesla Model 3 battery contains less than ¼ the amount of cobalt than their batteries in the VW ID3 – due to be launched in 2020. Meanwhile, Tesla is working on eliminating it entirely from their battery cells.

A clear demonstration of the difference incentives make is Musk’s comment at the shareholder’s meeting that Tesla may get into the mining business.

As we scale battery production to very high levels, we actually have to look further down the supply chain. We might get into the mining business. Maybe. A little bit, at least.

Of course, this comment resulted in a barrage of criticism and mockery. But, everyone missed the point. Musk will do anything necessary in order to ensure Tesla has sufficient supply to meet his ambitious goals, while the rest of the industry will do anything to continue selling their more profitable gasoline-powered vehicles.

Speaking of incentives, the dealership model is an additional headwind to EV sales. The majority of dealership profits come from service. Since EVs need very little service, dealerships have powerful incentives not to sell EVs. I saw this when I went to test drive the Jaguar I-Pace (read my review here) and the salesman didn’t even try to sell the car. This is why Tesla has fought hard to use a direct sales model, even in the face of being banned in some US states thanks to the political muscle of the dealerships. This was a bold, smart move by Tesla that traditional automakers will be hard-pressed to match.

Another major advantage that Tesla has developed is its charging infrastructure. Read this article to get a sense of how painful driving a typical EV is today is on a round trip from Los Angeles to Vegas (“8 hours driving, 5 more plugged-in”). In comparison, I did an amazing 6,000-mile road trip in my 2014 Model S in the winter of 2016 with zero issues.

It’s great to see that Electrify America is adding high-speed chargers across the U.S., but they’re still way behind Tesla. And once you realize that VW is funding this effort only because it was forced to do so by the U.S. government as part of a settlement for the Dieselgate scandal, you see once again that the auto incumbents are far from all in.

Tesla’s technology lead is large and may be increasing

Tesla’s lead in EVs is apparent when you consider that no competitor has managed to match the efficiency and range of the Tesla Model S…from 2012! How such well-funded competitors could possibly still be so far behind can be explained largely by incentives, but there is much more to the story.

The most skilled and innovative engineers flock to work for Tesla. The company placed as the second most attractive employer – after SpaceX – for engineering students in a recent survey. Elon Musk’s ability to attract top talent has been crucial to Tesla’s success and its technological lead.

This lead is obvious when you consider Tesla’s EV powertrain, but it is also clear when you analyze Tesla’s seamless integration of hardware and software. The future car is a computer on wheels and no car manufacturer rivals Tesla’s talent in this area, including the ability to update software over-the-air. These OTA updates have been accelerating and improving since their introduction in 2012 while other companies have barely begun offering them – GM recently announced that it will offer them, but not in every model, and not until 2023.

Tesla’s advantage in human capital compounds over time, as A-players tend to love working only with other A-players. As Steve Jobs once observed, the difference between an average software engineer and the best software engineer is “fifty to one, maybe one hundred to one.” The big auto incumbents don’t stand a chance attracting the same talent.

Hardware and software integration is becoming even more important as autonomy advances. Although there has been a lot of skepticism regarding Musk’s autonomy claims, NVIDIA legitimized Tesla as its only competition in the AI self-driving space in a blog post after Tesla’s Autonomy Day:

Indeed Tesla sees this approach as so important to the industry’s future that it’s building its future around it. This is the way forward. Every other automaker will need to deliver this level of performance.

There are only two places where you can get that AI computing horsepower: NVIDIA and Tesla.

While I don’t claim any special insight into Tesla’s plans with their recently acquired Maxwell dry cathode battery technology, if they successfully execute here it’s unlikely the incumbents will catch up in battery tech in the next decade.

Tesla’s lead in EVs and the integration of hardware and software is substantial and may be increasing. It will take years for other car manufacturers to get where Tesla is today – but the problem for them is that Tesla is a rapidly moving target.

The key question for bears is: Why wouldn’t the company with the best incentives, people, and technology win?

There is strong demand for Tesla’s cars

It seems to be popular wisdom in the finance community that Tesla’s market is small – limited mostly to coastal tree-hugging elites or tech bros – and has already hit a wall. In addition, the number of competitors coming down the pike will compound this problem and put an end to the growth story. Look no further, the bears say, than the first quarter numbers and Tesla’s price cuts.

But there’s evidence that demand has rebounded strongly as Tesla sold a record 95,200 cars in the second quarter – a big jump from the first quarter’s 63,000. Even though this fell right in the middle of their guidance, it far surpassed everyone’s expectations including most bulls. Although bears have now shifted their focus to margins and second half numbers, there is a good chance they will be cash flow positive this quarter and have more than $5 billion in cash on hand.

If the “demand cliff” so integral to the bear thesis – which has now been moved forward 6 months - is wrong and second half numbers are better than expected, I think the short thesis will unravel and the stock will soar.

Big picture, I believe Tesla is the only company in the industry that is doing innovative and exciting things – and nobody else is even close. This is why the Model 3 is the best selling car in the US by revenue and 63% of trade-ins for the vehicle are from non-premium vehicles. This trade-in data can’t be emphasized enough as it shows that many people are spending more on the Model 3 than they ever have on a car.

Alex Roy – a well-known rally race driver and Musk critic – sums up my thoughts here on why this is happening:

Hilariously, $TSLA shorts and OEM publicists would have us believe the next "Tesla Killer" will deliver because a dozen committees met and everyone ticked their boxes. None of them understand what they're up against.

All of Musk's bulls**t, exaggerations and pettiness don't matter because once you get in a Tesla, there really is nothing else like it. Mine isn't perfect, and I don't care. I want what it does, and don't care about what it doesn't. I want to live the dream. I want to drive the future.

Remember, this is coming from a Tesla critic. Imagine how people who love the company and Musk feel about the car? Actually, you don’t need to imagine as Tesla topped Consumer Reports’ owner satisfaction list for the third year in a row, even with all the reliability issues and negativity surrounding the company. The majority of Tesla owners (myself included) are passionate evangelists for the company – bears underestimate the power of this at their peril...

While bears focus on quality and service issues, they forget that Tesla relentlessly strives for continual improvement and it has a growing “sales force” of tens of thousands of new customers a month – the majority of who are incredibly happy with their cars.

Tesla is destroying the competition with the Model 3 and this is before it enters the most popular segment, crossovers. Although the Model 3 was indeed a “bet the company” program, it’s only a warm up for the Model Y.

Tesla plans to sell more Model Ys than S, X, and 3 combined given the size of the crossover segment. And given that 75% of the parts in the Model Y are shared with the Model 3, I think both the cost and speed of the Model Y launch will surprise everyone.

Tesla sold 245,000 cars globally last year – about the same it sold in its entire existence before 2018. It has grown revenues at a 93% annual rate since it started selling the Model S in 2012, and I believe it can grow at a very high rate for many, many years given that it’s still only a tiny fraction of the total market. It sold a mere 0.29% of total cars worldwide last year. Do the bears really believe that Tesla’s market share a few years from now will still be 0.29%???

To see how wrong the bears have been, consider this 2014 article by one of the best known, Mark Spiegel of Stanphyl Capital: “Why Projections For Tesla To Sell 500,000 Cars In 2020 Are Absurd.” He wrote:

Conclusion: even if Tesla were able to grow as quickly as Microsoft did in its prime (an absurd scenario for a non-monopolistic, non-software company) it would produce only 186,000 cars in 2020.

Tesla beat this number by 32% - in 2018.

Tesla’s true competition is the hundreds of thousands of ICE (internal combustion engine) vehicles that roll off the production line every day globally, not the trickle of inferior “Tesla killers” that are really just boring old cars that happen to be electric.

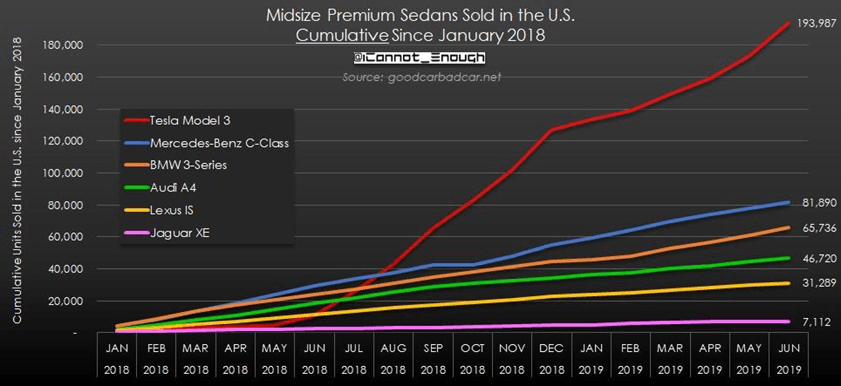

This chart of cumulative US Model 3 sales against its closest competitors speaks for itself:

Profits and Valuation

To my knowledge, there have been no profitable EV programs to date anywhere in the world without government incentives due to the high cost of batteries. In fact, the majority of manufactures lose at least a few thousand dollars per vehicle with government incentives. This is why most carmakers only make EVs to satisfy regulators and clearly haven’t made much of an effort. They tell themselves that EVs are not profitable and consumers don’t want them so what is the point of making the massive investments necessary?

But EVs are much simpler than ICE vehicles and have 90% fewer moving parts, so they have the potential to be more profitable than ICE vehicles if battery costs can be reduced substantially through scale and innovation. To do this, however, you need a massive amount of capital and conviction – and, of course, the will to design EVs that people actually want to buy. The incumbent automakers have the capital, but are still lacking the conviction and this is why they are still way behind Tesla on battery costs and efficiency, with no signs of catching up.

Sandy Munro, a well-respected auto consultant, was surprised to see that the Model 3 has the potential for a 30% profit margin and claimed, “No electric car is getting 30%. Nobody.” Whether Tesla can achieve this with their current cost structure and manufacturing issues remains to be seen, but the fact remains they are the only company making the necessary investments to produce a desirable, profitable EV without incentives.

One of the most famous valuation experts in the world, Professor Aswath Damodaran of NYU Stern School of Business, has estimated Tesla can achieve 10% operating margins five years from now in his latest analysis, in which he calculates intrinsic value of the stock at $190/share.

His work is exceptional, but I believe his estimates of $100 billion in revenue ten years from now underestimates Tesla’s potential by at least 50-100%. In 2014, Mark Spiegel wrote that Tesla producing 186,000 cars by 2020 would be an “absurd scenario,” - yet tripling this number is a real possibility. Analysts and investors have consistently underestimated Tesla’s sales, which is why I think doubling Damodaran’s 2028 estimates of 1.6 million cars is an achievable goal, giving them a global auto market share of ~3%.

The U.S., China, SpaceX put

No discussion of Tesla is complete without touching on the negatives – although you can just go to Twitter for that!

Professor Damodaran also increased his probability of failure to 20% due to Tesla’s increased debt load. When asked why he bought such a risky stock at $180/share with only a 5% margin of safety, he sent us a lesson he did on margin of safety and said that he thinks Tesla’s stock has a positive tail and a downside floor, “partly from the possibility of autonomous cars and partly because there is a chance that it could end up dominating the EV business, and bringing in the possibility of an acquisition floor tilted the balance.”

Besides the acquisition floor, I believe there is another form of downside protection that no one is talking about. China allowed Tesla to build the first 100% foreign-owned and operated auto plant in the country because they are so committed to electric cars. In addition, it appears that the government really wants the company to succeed and the Chinese love the Tesla brand and Elon Musk.

China has the biggest auto market in the world and is leading the world in EVs. If electric cars are the future, when will the U.S. wake up and realize that China is way ahead in this important industry of the future and it needs to start being more supportive of it… and the world leader in the space – Tesla. When the two biggest economies in the world are competing with each other – and both want Tesla to succeed —I can see many ways in which this might benefit the company, from access to capital to building new factories.

Lastly, don’t forget Musk’s other moonshot (pun intended) company, SpaceX. Its valuation has continued a steady climb – almost doubling since Morgan Stanley analyst Adam Jonas first brought up the idea of a Tesla-SpaceX merger in 2017. In his latest investor call, Jonas seemed particularly keen on the idea. In this scenario, Musk would use his 54% ownership of SpaceX as collateral for a loan to help take Tesla private.

All of this is speculation, but bears shouldn’t discount the incredible optionality and downside protection that exists in many forms at Tesla.

Conclusion

Tesla is disrupting a trillion dollar industry through bold bets, conviction, and innovation. Its technology and the human capital advantage behind it have created the first lineup of desirable, profitable EVs that have the crucial hardware and software integration that is necessary for future autos. Meanwhile, incumbent automakers are trapped in a classic innovator’s dilemma, as can be seen in their results and decisions to date.

As a result, I think we’ll see in the next 6-12 months that demand for Tesla’s EVs will be stronger than Wall Street expects, resulting in sales, margins, and cash flows that far surpass expectations enabling them to continue growing rapidly and funding their continued expansion.

This year has been a difficult one for Tesla as it struggles to drive efficiencies in order to introduce more affordable versions of the Model 3 and refresh their higher end models while maintaining margins after a big step down in the US EV tax credit. Bears smelt blood in the water and have finally made some money, but - in reality - this was nothing but a bump in the road of insane growth and demand for their cars will get them back on track.

Although likely to remain volatile, I believe the stock will keep it’s relatively high multiple due to Tesla’s continued lead in the future auto market and the share price will be much higher a few years out as operating margins continue to improve.

If I’m wrong and demand and/or margins disappoint, there is downside protection as Tesla has valuable assets (technology, people, brand, etc.).