PHEVs shine in disrupted market

The European passenger plug-in market registered 112,000 registrations in January (+50% YoY), with PHEVs (+85%) growing faster than BEVs (+18%), with PHEVs starting the year ahead of BEVs (42% BEVs / 58% PHEVs).

Last month positive result, added to a crashing overall market (-26% YoY), allowed the 2021 plugin share to start at 14% (5.6% for BEVs alone), already above the final 2020 PEV (11%) and doubling the result of January 2020 (6.6%).

With the plugin share already starting firmly above 10%, disruption is here to stay and the 20% mark for 2021, that i expected a month ago, now not only looks reasonable, but one can even imagine it ending above that score!.

In January, PHEVs were the stars of the show, not only winning the Best Seller trophy for the first time in years, thanks to the surprising Volvo XC40 PHEV, but also by placing 2 models in the Top 5, for the first time since last August, as the BMW 330e(!) reached the 4th place last month.

And the surprises do not ended there, as the Kia Niro EV won the last place of the podium, although the 3,123 units weren't enough to beat the #2 Renault Zoe, that lost the leadership race by a mere 23 units, while the VW ID.3, said to be the favorite candidate to win the 2021 title, was only 5th.

In a month where the overall market saw the perennial leader VW Golf drop to 4th(!), behind the #1 Toyota Yaris(!!), #2 Peugeot 208 (!) and #3 Dacia Sandero (!!!), and the usual runner-up Renault Clio starting only in #7, added to the fact that plugins are becoming increasingly mainstream, the European automotive market is definetely into little known waters, although for now we shouldn't read too much into these early results, but i believe by March we should have a clearer view of what's going on, and the if disruption is indeed hurting the previous status quo.

Also important to know, will be if the possible weakness of the VW Golf and Renault Clio is due to buyers directly flocking to their EV counterparts (ID.3 and Zoe), or are they moving into other options on the market.

Bring on the popcorn, because the next few months will surely be fun to watch!

Looking at the Monthly Models Ranking:

#1 Volvo XC40 PHEV – With electrification high on Volvo's priorities list, the Swedish brand is, along with Porsche, the two most electrified legacy makers in Europe, the PHEV version of the compact SUV hit 3,543 units last month, winning for Volvo its first monthly trophy, highlighting the good growth prospects in 2021 for the brand, especially considering that its BEV sibling (1,027 units last month) is only just starting, with a number of markets still without units delivered. While the XC40 PHEV major market was Germany (573 units), there were several others also helping in significant volumes, like the Netherlands (367), France (357), the UK (350), Belgium (434) and Italy (399).

#2 Renault Zoe– The 3,520 deliveries of January haven't allowed it to start in the lead, but with only 23 units separating if from the leadership, it really doesn't mean anything for future prospects. Back to January, Germany (1,166 units) and France (1,013) pulled the usual heavy lifting, with Italy a distant 3rd, with only 255 registrations.

#3 Kia Niro EV – The Korean crossover scored 3,123 units last month, a 137% surge regarding the same month last year, although this might not mean that the Niro EV will have an outstanding 2021, as it might be just the result of Kia's allocation policy. To be continued... Looking back at January results, the two main markets were the UK (950 units), followed by France (748 units, a new record), with Germany being a distant third (350 registrations).

#4 BMW 330e– Now this was a surprise. The German midsizer joined the Top 5 and became the leader in its category, with 3,058 units. With BMW's plugin hybrid profiting from a fortuity of circumstances, like the fact that the Tesla Model 3 was in an off month, and the Mercedes C-Class arch-rival being close to a generational change (the new PHEV version has 100 kms (62 mi) electric range! and CCS!), the BMW plugin hybrid managed to pull off this good result, although one wonders for how long with BMW's model manage to keep this status. Looking at individual countries, the UK (1,100 units) and Germany (763), were its largest markets, with the following being Belgium (263) and Sweden (244).

#5 Volkswagen ID.3– The German model hit a meh 2,978 units last month, which is somewhat disappointing, but with production still ramping up, we should see a very strong March, with the following months being the real test to the VW EV demand and/or production priorities, as the German maker might prioritize the more profitable ID.4 over the ID.3... Regarding January performances, the Volkswagen hatchback registrations were heavily concentrated in Germany (1,799), being followed from a far by Austria (199), and France (142). Interesting that they focussed January deliveries in markets close to the factory, isn't it?

|

| Peugeot 508 PHEV |

Looking at the remaining ranking, BMW and Peugeot impressed, with the German maker placing 4 models in the Top 20, while Peugeot had 3, with one of them, the 3008 PHEV, even scoring a record result (2,680 units), and while BMW Top 20 line-up was all PHEV and SUV-heavy (3 SUVs), Peugeot had had two BEVs, while looking at the broader Stellantis line up, the new conglomerate also placed 4 models to the table, because on top of the 3 Peugeot's, the Opel Corsa EV also managed to find a spot in the table, in #20.

Regarding fresh faces, a mention to the 12th spot of the Mercedes GLE350e/de barge SUV, after a looong production ramp up, it seems to be a tradition now in Mercedes, the long range SUV is finally living up to its specs (31 kWh battery and CCS charging) and being delivered in large numbers. Coincidentally, its BMW arch rival, the X5 PHEV, is also back at the Top 20, which underlines a recent trend, big SUVs are being electrified faster than the rest of the market.

Outside the Top 20, two recent models deserve a mention, the Toyota RAV4 PHEV continues its deliveries ramp up, clocking an already relevant 1,253 units last month, while the Citroen C4 EV is also ramping up, having registered 536 units in January.

In the manufacturers ranking, BMW profited from strong results from its (long) lineup and started the year in the lead, with 10% share, followed by a pack of competitors, leaded by Volkswagen, Peugeot and Mercedes, all with 7% share each, with Renault and Volvo following immediately, both with 6%.

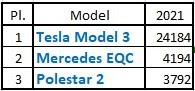

BEV D-Segment / Midsize category

Tesla's midsize sedan sales started in the low end, with 1,499 deliveries, only 11 less than a year ago, but expect the sports sedan deliveries to jump significantly in March, thus distancing itself from the #2 Mercedes EQC (1,354 units) and Polestar 2 (1,297).

Tesla's midsizer won't have significant competition in the near future, at least until its Model Y sibling lands, as the Polestar 2 is still too expensive to reach higher volumes and the EQC...Well, that one is just happy to keep Silver while it can.

The upcoming Ford Mustang Mach-E production levels are still a question mark, and as for the BMW iX3, i believe the Bavarian maker will already be happy if it comes close to the the Mercedes EQC...

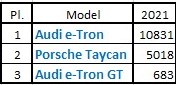

BEV E-Segment / Full size category

The e-Tron domination continues to grow, with the Big Audi scoring 2,621 units last month, with its sales growing 16% YoY, considering the already significant sales volumes of the Belgian-made Audi, one wonders for how long will the growth rates will be sustained, and when will the peak e-Tron moment arrive...Maybe when the Q4 e-Tron is presented?

With the #2 Porsche Taycan (1,094 units last month) accelerating its sales, the main interest is now the 3rd spot, where the luxury van with windows Mercedes EQV (168 units) has managed to beat both flagship Teslas.

2021 will se a lot of action in this category, not only with several models landing (Audi e-Tron GT, Mercedes EQS, BMW iNext...), but with also the flagship Teslas redesign and the Porsche Taycan lineup expansion (RWD, Cross Turismo...), the Audi e-Tron will have a harder time keeping the full size crown.